WASHINGTON- CE industry veterans are seeing some signs that business is rebounding, but they said it’s still too early to tell if the recession is reaching its bottom.

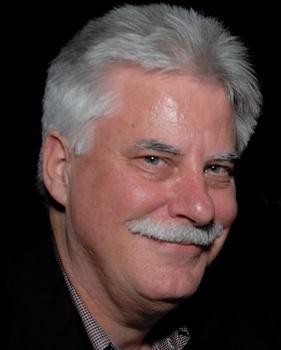

"I do think we’re near the bottom," said a cautiously optimistic Henry Chiarelli, president of DBL Distributing, at the opening reception of the

Consumer Electronics Association’s annual Washington Forum. "We’re now tracking sales month over month, and we’re selling more today than we were yesterday."

DBL’s hot categories include pro AV, gaming and cell phone accessories. "Those are going nuts," he said, adding that home security products are also picking up.

The custom installation market – including mounts, controls and power devices – is still soft, based mainly on the slump in new housing, Chiarelli said.

"I think the consumer nesting and cocooning will eventually run it’s course, so we’ll need a lift in the new home market to pick things up," he said. "When that changes, everything will start to pick up."

Despite the unstable global economy, many people attending the reception, held at the Newseum, said they’re witnessing glimmers of hope in their markets.

"We’re seeing that people aren’t as afraid to spend as they were in the first quarter," said Daniel Pidgeon, CFO of Starpower, a specialty retailer in the Dallas area. "They’re finally finding a level of comfort in moving forward with their CE purchases."

Those signs have left Pidgeon feeling more optimistic than he has in months.

"I like to think we’re at the bottom and building up; but until we get through a good, solid quarter of consistent growth, it’s still too early to tell," he said.

While the recession has been clobbering general CE retailers, Skip West, president of Maxsa, a Virginia based developer of solar lighting and security products, said he has been seeing increased sales through non-traditional and online-only retailers such as Earthtech Products and SolarLightStore.com.

"Even with oil prices going down, people still want to be green," he said. "It’s such a fast-growing category."

The success some e-tailers are seeing with niche categories can easily carry over to traditional retailers who are looking to differentiate themselves, draw incremental traffic and increase sales.

"Retailers are missing the boat if they haven’t established some type of green section or focus," West said.

David Mann, president of ACE Marketing, a rep for LG, Triad Speakers, Fortress Seating and other products, said consumer demand is increasing, but inventory constraints have hampered sales, especially for the more popular plasma and LCD TV screen sizes.

"The spring has been wound tight for so long, I think it’s starting to break loose," he said, regarding consumer spending. "But inventory has shrunk because suppliers have been so cautious: parts suppliers have backed off, panel suppliers have backed off."

Mann said LG and other suppliers have indicated they will be releasing more inventory into the channel in June. "I’d love to have more 60-inch plasmas to sell."

Steve Koenig, CEA’s director of industry analysis, said preliminary research shows that sales of several CE categories slowed in March, which helps explain the constrained inventory. "Early signs show a definite pull-back in the channel," he said, adding that the early numbers shouldn’t cause alarm "but they are not what we expected."

"There are lots of signs that we’re hitting the bottom, but it’s still too early to tell," Koenig said. "The big question for me is what sentiment will reign: optimism or pessimism."