Apple has embraced the ethos of modern picture makers who, ironically, are seeking a connection to the analog world. For those of us who studied analog technologies, print processes and also photo output, that special analog look was achieved with processes such as gum bichromate, cyanotype, dye transfer, collodion and many others. These were painstaking processes that took hours to produce images.

Shortly before photokina 2016, Apple introduced its iPhone 7 Plus, the first smartphone to combine dual focal length sensors, employ image stabilization and shoot in RAW-DNG. It also draws on Apple’s supercomputer development capacity in imaging software.

As a result, analog looks are achievable with presets in mobile applications and desktop software. You can create the look of a master photographer/printer with the touch of a button.

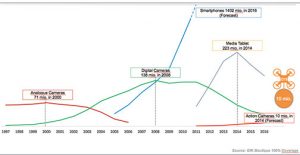

During photokina, GfK (gfk.com) conducted three market briefings. Figure 1 illustrates the worldwide unit sales of different imaging devices from the mid-1990s.

Figure 1: The Impact of Digitization and the Internet on Photo Image Capture Devices

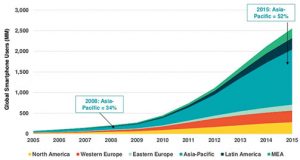

A 2015 GfK/BVDW study of the German market indicates that consumers use their smartphones 33 times/day, 66% of respondents use their smartphones to wake up, and 75% of respondents even use them in the toilet. Behavior of smartphone users may vary around the world, but this is indicative of how often these devices are being used. And the number of smartphones around the world is proliferating, as shown in Figure 2.

Figure 2: Global Smartphone Users by Region

Source: KPCB Internet Trends 2016 (Nakono Research 2/2016)

Source: KPCB Internet Trends 2016 (Nakono Research 2/2016)

VR (Virtual Reality) is ready to take off thanks to many new cameras being introduced, including action cams. Imaging in combination with virtual reality has limitless uses beyond communication.

This will drive demand in tomorrow’s technical markets. While some companies have had only mediocre success with VR up to now, we believe that aggressive pricing and competition will take effect among professionals and amateurs. VR can apply to many markets, such as real estate, travel photography, action video and documentary projects. And the proliferation of photo drones should drive this market segment even faster.

Unfortunately, photo retailers are competing with online companies for the sale of picture-taking systems, and even for photo merchandise. With intense price competition in equipment sales, how do photo retailers monetize this technology? Through output!

How do consumers use their captured images? We know they are uploading images to social networks. In 2015, the average daily number of uploaded images was 524 million on Facebook, 239 million on Snapchat, 505 million on WhatsApp and more than 30 million on Instagram. Large print service provider (PSP) companies are producing photo books and other products from these uploads, but are photo retailers able to do the same?

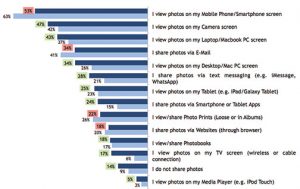

Studies by Futuresource Consulting in 2014 and 2015 of consumers in France, Germany and the U.S. provide some insight into how consumers are using the images they are capturing on their smartphones, with a comparison of 2015 (dark lines) to 2014 (light lines) and the change that has occurred over 12 months (see Figure 3).

Figure 3: What People Do with Their Digital Photos

Source: Futuresource Consulting

The premium photo book category offered by PSPs is the lay-flat book, which enables panorama prints to cover two side-by-side pages. Produced with high-speed production systems, these books are often printed on photographic paper for the top quality, although the quality of some digital printers has improved to the point of being comparable.

For photo retailers, this has not been so easy. However, Unibind introduced UniPaper this year, which makes the paper lay flat by putting a double fold near the edge of every sheet. These folds break the fiber in the paper without tearing it and the book will lay open by itself on the folds. This produces photo books that can show double-page and panoramic spreads.

Three options are available. 1. The photo book fulfillment company uses ready-made paper that contains the preset fold. 2. The photo book fulfillment company uses a Unibind lay-flat folding machine. This machine puts the folds in the paper before or after printing at 9,000 sheets/hour. 3. In the retail environment, a compact lay-flat folding station can put the double fold on prints coming from kiosk printers. UniPaper complements the company’s UniCover system, which can be used for presentations, reports, proposals and contracts, besides photo books.

Continued Investment

The large PSPs continue to invest in their equipment, their marketing and their infrastructure. They have evolved from e-commerce companies offering photo merchandise. And they are overcoming the commoditization of the print business by diversifying and partnering. For photo retailers, the ability to compete, providing websites that offer the same experience for desktop and mobile access, is challenging.

For his PhD thesis, Bob Banasik studied the photo retailing market. He wrote a summary titled How Specialty Retail Can Grow Revenues (http://tiny.cc/z823gy). Ten or 15 years ago, a central value proposition promulgated by photo industry companies focused on the sharing and preservation of memories—using the ubiquitous 4×6 print. Today that is irrelevant—smartphones are used as the primary sharing and preservation method.

Some respondents in Banasik’s study felt smartphones had decimated much of the photo printing market. And the few orders they did receive were too small to be profitable. Raising prices could be successful, however, if the goal is to discourage small orders.

B2B Photo Output Strategy

But what if the goals included marketing strategies and new markets? Some retailers tend to ignore the business-to-business (B2B) segment. And this group often has much greater potential spending power than consumers. But establishing relationships might require creative contact methods.

Consumers find relevance in value propositions based upon memories, gifting, holidays and display. Commercial markets could be defined through intended images. Each defined target segment can present opportunities for differentiation, unique branding narratives and discrete marketing communications that can be more effective than traditional mass marketing.

Not too long ago, yearbooks were the domain of large, specialized companies. Today software is available to enable groups to easily create the content and then seek a source for printing.

Larger companies are growing revenues by targeting many diverse market segments. That is how the large PSPs have evolved into profitable giants. Smaller companies are targeting fewer segments but are still benefiting from marketing communications and direct-marketing methods aimed precisely at highly relevant value propositions.

Retail stores offer marketing communication benefits that are not easily replicated by online retailers or through manufacturer-driven marketing. These include conspicuous displays and experiential differentiation. These differences can have significant implications in market segmentation and also provide competitive advantages.

Successful diffusion of innovation requires innovators to inspire word of mouth among larger consumer groups such as early adopters. If the industry never grows the pool of innovators by creating awareness in new markets, the consumer life cycle matures faster, and the market deteriorates.

Large PSPs are diversifying into the B2B segment through mass- and even targeted marketing. But retailers provide essential exposure to new markets unaware of new products and benefits by “informing” consumers, who work at businesses, on how they can use their images.

The Profit Potential of Photo Output

At photokina, Fujifilm and CeWe showed the wide range of products that could be produced from images, even on traditional photographic paper. DNP has developed a method for producing panorama prints on its dye-sub printers—“fusing” two regular prints together. ChromaLuxe aluminum prints, available in sizes up to 4×8 feet, can be safely displayed without the need for framing under glass or acrylic, face-mounting or surface lamination.

The loss of the photo print business has been surpassed by the infinite opportunities to monetize images in many ways. For photo retailers willing to invest the time to educate their customers, both consumer and B2B, about new, innovative products and services, the future is positive.